Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

We have different types of cover for whatever you have planned. And we consider all medical conditions.

Offering cover for anything from a short UK break to a year of travelling around the world

Travelling more than once this year? An annual multi-trip policy could save you time and money

Looking for a gap year, career break or to travel the world? We could have the cover you're after

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days

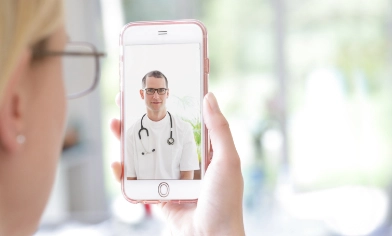

Have peace of mind when you travel knowing that health professionals are just one click away.

Medical Assistance Plus (3), powered by Air Doctor, comes free with all our travel insurance policies. It gives you access to outpatient medical support while you’re abroad.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

If you have a health condition it shouldn't stop you seeing the world. And, with the right cover, you can travel with peace of mind.

Post Office covers most pre-existing medical conditions. So contact us for a quote, tell us about all your conditions and any prescribed medications you take and we’ll help if we can.

If we can’t help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777.

We can offer you a choice of economy, standard and premier cover levels.

|

Economy £125 excess Insurance Product Information Document (IPID) Emergency medical expenses and getting you back home Up to £5 million Cancellation and cutting short your trip Up to £1,000 Baggage (personal possessions) Up to £1,500 Money Up to £250 Missed departure n/a |

Standard £99 excess Insurance Product Information Document (IPID) Emergency medical expenses and getting you back home Up to £10 million Cancellation and cutting short your trip Up to £3,000 Baggage (personal possessions) Up to £2,000 Money Up to £350 Missed departure Up to £750 |

Premier £50 excess Insurance Product Information Document (IPID) Emergency medical expenses and getting you back home Up to £15 million Cancellation and cutting short your trip Up to £5,000 Baggage (personal possessions) Up to £3,000 Money Up to £500 (4) Missed departure Up to £1,500 |

|

|---|---|---|---|

|

Insurance Product Information Document (IPID) |

Insurance Product Information Document (IPID) |

Insurance Product Information Document (IPID) |

Insurance Product Information Document (IPID) |

|

Emergency medical expenses and getting you back home |

Emergency medical expenses and getting you back home Up to £5 million |

Emergency medical expenses and getting you back home Up to £10 million |

Emergency medical expenses and getting you back home Up to £15 million |

|

Cancellation and cutting short your trip |

Cancellation and cutting short your trip Up to £1,000 |

Cancellation and cutting short your trip Up to £3,000 |

Cancellation and cutting short your trip Up to £5,000 |

|

Baggage (personal possessions) |

Baggage (personal possessions) Up to £1,500 |

Baggage (personal possessions) Up to £2,000 |

Baggage (personal possessions) Up to £3,000 |

|

Money |

Money Up to £250 |

Money Up to £350 |

Money Up to £500 (4) |

|

Missed departure |

Missed departure n/a |

Missed departure Up to £750 |

Missed departure Up to £1,500 |

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

Travel insurance may be able to protect you against a range of unexpected events. From losing valuables to medical emergencies, and anything else that could spoil your holiday. Take a look at our policy documents to make sure that you’re getting the cover that meets your needs.

We'll repay you for any non-refundable, unused travel and accommodation costs if you have to cancel or cut short a trip due to reasons set out in the policy. This includes pre-booked activities and excursions, car hire, cattery and kennel fees, up to the limits shown

We may be able to help if you need emergency medical treatment, return to the UK (getting you back home) and more while you’re abroad

We’ll also cover any extra travel and accommodation costs you're charged if you arrive too late to travel on your booked transport. As long as they match the reasons set out in the policy

You're covered if your international departure is delayed by 4 or more hours. As long as it matches certain reasons set out in the policy wording

Items that are usually carried or worn during a trip are covered if they get lost, stolen or damaged

You'll also get protection for any unexpected legal costs you might be charged while you're away

(6) Delayed and missed departure are only available with our standard and premier cover levels.

Best Travel Insurance Provider

Post Office won a “Best Travel Insurance Provider” award at the Your Money Awards in 2021, 2022, 2023, and 2025

Best Travel Insurance Provider

Post Office won a ‘Best Travel Insurance Provider’ award at the MoneyFacts Awards in 2024 and 2025

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Post Office Travel Insurance can cover you for a single trip of up to 365 days (2), or multiple trips in a single year. This applies to trips taken anywhere in the UK and abroad too. We also offer backpacker cover (7) for a single trip of up to 18 months.

The type and level of cover provided depends on the insurance policy type and options you choose. It can include cover for:

You can add additional cover to your policy. Options include:

Winter sports cover is compulsory for winter sports trips and cruise cover is mandatory if you’re going on a cruise. It’s important to check the different travel insurances available, and their various options and add-ons you can buy. This way, you’re sure to be fully covered for your trip and all you’ll do on it.

Having travel insurance is a worthwhile purchase for anyone going abroad for their holidays. Even in relatively safe locations such as central Europe, a number of things can go wrong.

Flights can be delayed. Airlines can lose your luggage. Tourist areas may be prone to opportunist thieves who may target your belongings. And you could fall ill anywhere in the world, to the detriment of your holiday plans.

We hope that none of these events happen to you. But, if they do, you could be out of pocket. And with emergency medical problems it could be by tens or even hundreds of thousands of pounds.

Holiday insurance may be able to help avoid some of this risk. It’s a way to insure for travel you, those travelling with you and your belongings.

If your luggage is lost, holiday insurance may not be able to replace it, but the payout from a claim can help recover any costs that you have had to pay to get replacements.

In particular, the medical cover outside of the EU offered by insurance is a necessity.

Within the EU, you may think that an European Health Insurance Card (Ehic) or its replacement, the UK Global Health Insurance Card (Ghic), can cover all your medical needs. This isn’t true. Some of the most expensive medical services, such as repatriation, aren’t covered by the Ehic or Ghic. They're limited to health cover and won’t help at all with things like cancellation, loss or theft. And the Ehic no longer provides access to healthcare for UK nationals travelling to Iceland, Liechtenstein, Norway or Switzerland.

Even if you’re staying in the UK for your break, having holiday insurance will provide cover for lost, damaged or stolen possessions such as baggage, and cancellation, cutting your trip short or delay to your trip in some circumstances.

To qualify for cover on our annual multi-trip policies, UK trips must consist of:

You’re in safe hands with Post Office. We won Best Travel Insurance Provider at the Your Money Awards in 2021, 2022 and 2023. We also won bronze for Best Travel Insurance Provider at the British Travel Awards 2023, voted for by the UK public.

Our premier cover is 5 Star Defaqto Rated. Defaqto is a financial information business, helping financial institutions and consumers make better informed decisions.

We have a range of cover options available to suit lots of different holidays, so you can choose the cover that suits you best. We’re there for our customers when they need us the most; in the last five years, we’ve paid out over £62 million in claims.

Our policies provide cover for cancellation for Covid-19 if:

If an insured trip has to be cut short, the unused portion of it can be claimed for if:

There's no other coronavirus cover on our policies but, for extra reassurance, you can add our trip disruption cover upgrade option. This gives you added protection against missed departures and expenses charged due to change of testing or quarantine requirements. Add it to your preferred policy for an extra premium.

Should the FCDO advise against all travel to your destination, there's no cover under any section of the policy if you decide to travel.

If the FCDO have advised to only undertake essential travel to a destination and your trip's not essential and you choose to travel, we'll only cover a claim if the cause is not linked to the reason for the FCDO advice. This limitation applies even if you've purchased an optional trip disruption cover upgrade. You may be able to travel with full cover if we authorise in writing that your trip's essential before you depart. Should you like to request this, please email travelinsurancefeedback@postoffice.co.uk

Please make sure you’re clear what’s covered and what’s not. Check the answers to common questions about coronavirus cover and the full policy wording for more details.

Yes, our travel insurance covers you for unexpected medical expenses. This includes emergency treatment and hospitalisation, plus repatriation if you need it. Cover's provided up to the limit specified in the policy wording for the specific cover level you choose.

Emergency medical assistance

If you need emergency medical assistance, you can call our dedicated team. They're here 24 hours a day, 7 days a week to get you the help you need. Check the correct contact details for your policy on our travel insurance help and support page.

Non-emergency medical support

If it’s not an emergency but you still need to see a medical professional, you can use our Medical Assistance Plus (3) service. This outpatient service is included free with all Post Office Travel Insurance policies.

Get easy access to medical experts such as doctors, dentists and gastroenterologists. The single online platform can be used wherever you are abroad.

Choose whether you’re seen at a clinic, in your hotel or via an online video consultation. All sessions are in your own language. They even have prescriptions delivered to your nearest pharmacy.

This takes away the stress of finding medical help, so you can kick back and enjoy your holiday to the full.

We provide cover whether you’re taking a break in the UK or going on holiday overseas. You’re covered if your luggage or personal belongings are lost, stolen or damaged while you’re staying away from home in Britain. And if you have to cancel or cut short your trip in some circumstances, we can cover that too. As long as it matches the reasons set out in your policy.

Our annual multi-trip travel insurance can cover you for UK trips too. The minimum requirements are one night’s pre-booked and paid accommodation. Or your stay must be at least 100 miles from your home. Or you must have at least one sea crossing.

The UK Government provides guidance on travel 24 hours a day, 7 days a week. Visit the Foreign, Commonwealth & Development Office website for the latest travel information. It lists if it's safe to visit your chosen country. This information can change at short notice. So it's a good idea to check the FCDO page regularly.

Remember, your cover won’t be valid if you travel against the FDCO advice of all travel, and local government advice. Check the latest on the FCDO site or read our where can I go on holiday guide.

Our standard travel insurance policies will only provide limited cover for electronic items such as mobile/smart phones, camcorders and their accessories, all photographic/ digital/ optical/ audio/ video media and equipment, iPods, MP3/4 players or similar and/or accessories, e-book readers, and satellite navigation systems up to the single article limit. The single article limit depends on the cover you’ve taken out. For economy it’s £150, for standard it’s £250, and for premier it’s £400.

Gadget cover is an optional add on you can buy at any time to add protection for your devices. Check the policy wording for full terms.

Yes, there is. We’ve teamed up with Student Beans to offer both a student discount and graduate discount for money off travel insurance. Here’s how to get yours:

1. Visit the student or graduate link

2. Either register for an account (to verify your student/graduate status) or log in if you have already registered

3. You'll then be sent a unique code

4. Enter the code in the promotional code box when you get a travel insurance quote online

5. The discount will then be automatically applied to the quote provided.

(7) Backpacker policies only available on the economy level of cover.

(8) Immediate relative: your mother, father, sister, brother, spouse, civil partner, fiance/e, your children (including adopted and fostered), grandparent , grandchild, parent- in- law, daughter-in -law; sister-in-law, son-in- law, brother- in- law, aunt, uncle, cousin, nephew, niece, step-parent, step- child, step-brother, step-sister or legal guardian.

You can buy travel insurance and view your policy all in our free Post Office travel app. Plus you can order and top-up our Travel Money Card wherever you are too

Buy your travel money online. You can click and collect from a branch near you or choose next-day delivery to your home

With festivals overseas becoming the new norm, festivalgoers need to do a bit more planning than for a UK festival.

While it’s useful to take hard copies of travel documents away, you can minimise your worry and risk. Here are some handy tips on keeping your travel documents safe.

Satisfy your travel craving while making your holiday budget go further.

Find out what medical care Brits can access in New Zealand and travel risks to be aware of like natural catastrophes, however rare.

Before your little bundle of joy arrives, you may be considering taking a holiday. But is it safe? And what precautions should you consider before making a booking?

The white stuff is alluring, so make sure you can enjoy it safely, are ready for the unexpected and pack travel insurance for extra reassurance.

Read our guide to travelling in later life. We explore what to look for in your travel insurance, plus taking trips with your grandchildren.

Taking your best friend on holiday with you is everyone's ideal situation, but travelling with a dog can be a complicated process. Make sure you know how.

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder it’s so popular with holidaymakers from the UK and elsewhere.

Discover top places to visit, tips on staying safe and why travel insurance is essential for an unforgettable USA adventure

Over 60 million people travel from the UK most years for holidays or business. The vast majority enjoy smooth, trouble-free journeys. Sometimes, though, things go wrong.

Ready to jet off on a much-needed break but confused about what you can take with you on the flight?

Travel can help teenagers grow and discover new places. This guide shares the best trips for teens, advice for those travelling independently for the first time, plus tips for parents too.

Looking for holiday destinations that promise warmer days as UK temperatures start to fall? We can help with that.

Discover some top places to visit in Spain, tips on staying safe while you’re there and why travel insurance is essential for an unforgettable Spanish adventure.

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting alternative scene are a draw for Brits. A trip can be a once-in-a-lifetime event.

Travelling with kids? Before you get on the plane, read our quick and easy guide to help make sure your journey runs smoothly.

With the winter sports season upon us, we conducted a Winter Sports Survey for the second year running. It found as many as four in 10 UK travellers (39%) planned to take up a winter sports activity this year, with 25% keen to go skiing. It also emerged that many prefer winter escapes to summer ones. But has the nation considered all the protection we need for winter sports holidays? Or are we woefully underprepared?

Looking to escape the chilly UK winter? Our Winter Sun Survey reveals the top sunny destinations UK travellers are choosing this season. And learn why travel insurance is key for a worry-free holiday in the sun.

Looking for holiday destinations that promise warmer days in the UK’s colder winter months? We can help with that.

Whether you’re travelling solo because of business, you’re hoping to meet someone, or simply because you enjoy it, being by yourself can sometimes be a daunting prospect when you’re abroad.

If you’re thinking of heading abroad without insurance, think again. This guide explains why doing so can be risky, busts common myths about the need for insurance and shows how easy it is to protect yourself.

There’s no better feeling than planning an amazing trip to an exotic destination. Make staying safe with travel vaccinations top of your to-do list.

Spring is a great time to leave the cooler UK and go somewhere sunny. And we can help with that.

There are different rules for travelling to the Schengen Area from the UK since Brexit. If you’re visiting this part of Europe, find out if you need a Schengen visa and travel insurance.

Travelling solo means freedom and independence, making new connections and never having to compromise.

How safe is South Africa to visit and why is having travel insurance important when you go? Our guide looks at the potential travel risks and the cover you may want to look for in a policy.

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure consumers are covered if travel firms fall into financial difficulties.

Some vaccinations for Thailand are recommended and some are mandatory in certain circumstances. It’s important to know which vaccinations or injections for Thailand you need to get before you leave home.

Do you need travel insurance for your trip? Is travel insurance worth it? And, if yes, when is the right time to buy cover?

Travel’s a great way to unwind, see the world, open the mind and expand horizons. But rapidly changing situations around the world can soon impact such plans.

If you're the type of sunchaser who looks forward to that sizzling summer break, can’t wait to escape to warmer climes in the UK’s winter months or can't be away from vitamin D too long, we’ve got a few ideas about where to go.

Find the best places to visit in Australia, tips on staying safe and why travel insurance is a must for your trip.

Going backpacking is one of life’s great adventures. But before you set off you’ll need some packing tips so you're not weighed down on the way.

It’s one of the most popular holiday hotspots for UK holidaymakers. But what can you expect from a trip to the Balearics?

Adventure holidays come in all shapes and sizes. They can be full of action or just include a few activities, depending on the type of getaway you’re going for.

Finding out that your airline or holiday company has gone bust is a shock – especially if you’re on holiday at the time. But there are plenty of laws and regulations in place to protect you and your family from losing what could be a lot of money.

Lots of people who need assisted travel at airports are missing out simply because they don’t know how to go about asking for it.

Dreaming of turquoise waters and sun-kissed beaches? Planning the perfect Caribbean cruise starts with choosing the right time to go. This guide explores the best month for a Caribbean cruise, what weather to expect and how to prepare.

Bank holidays are special days off when many people in the UK don’t work. They’re a great chance to relax, travel, see family or catch up on things.

Ever dreamed of sailing to the world’s most exciting places? Cruises can make that happen.

Today, Cuba is more accessible than it has been for many decades, and those who decide to holiday there can expect a mixture of colourful city life and luxurious beaches.

The last thing you want to happen on holiday is standing the luggage carousel at the airport waiting for bags that don't appear. It's a huge inconvenience that can cost you time, money and a lot of stress.

Make sure you’re travelling safely in Egypt with the latest advice and risks, and learn about getting around and local culture.

If you're travelling to an EU country from the UK, make sure you take a Global Health Insurance Card (Ghic) with you or existing European health Insurance Card (Ehic), if it's still in date. You'll need them to access free healthcare during your stay, should you need it.

Learn the difference between embassies and consulates, and why you might need them when travelling.

You should be able to get the right cover to travel abroad if you’re diabetic, making sure that your medical needs are taken care of.

It’s easier now to mix business and leisure travel. Whether you’re planning a bleisure trip, taking a workation or exploring life as a digital nomad, there are more options than ever to work from anywhere with nomad travel insurance.

Travel insurance for a holiday in the UK isn't something you must have, but it might be something you want to have.

Discover top places to visit, tips on staying safe and why travel insurance is essential for an unforgettable Dubai adventure.

Going on a trip with your family is a great way to spend time together. It could be a holiday, a weekend away or a big trip abroad.

Most of the time, getting a flight is a hassle-free event. If you only take hand luggage, have your boarding pass saved to your phone and everything’s running to plan then you can breeze through security and hop on your flight with little fuss.

It may be a short hop away, but a trip to France is not without its travel risks. Make sure you’re clued up on what they are and have travel insurance in place to help protect you, so you can concentrate on just enjoying your break.

Exploring the globe can be scary, but there’s so much to find at the edge of your comfort zone. We look at some of the top destinations to visit on your own – and share tips on how to keep safe when you go.

Booking a last-minute holiday can get the blood pumping with the sudden thrill of adventure, but it also makes it easier to overlook things.

Whether you’re heading to the beach for a much-needed break or boarding a boat for a cruise somewhere breath-taking, it’s important to know what to pack in advance so you’ll have everything you need.

We all know the feeling – getting to the airport, then a wave of panic comes over you. Did you remember your passport? What time's the flight? And where on earth did you put the kids?

The whole idea of lounging around on the beach is to switch off and enjoy the sunshine. But the reality is that opportunistic thieves are on the lookout for unattended valuables, and it’s important to make sure you’re protected.

There’s nothing worse than falling ill while away from home. Along with the worry of the cost of visiting a doctor and getting treatment, being poorly can put a real dampener on your trip.

Find out about medical care available to Brits in Mexico, as well as travel risks, transport options and the importance of taking travel insurance.

Perched on the northern tip of Africa, Morocco’s long been a popular destination for UK holidaymakers. If you’re heading there soon, make sure you’ve got good travel insurance to cover you.

For many UK holidaymakers, India is an intriguing and diverse culture with colourful traditions and engrossing history. For many others, it’s a home from home.

Do UK residents need travel insurance for Ireland? And what healthcare is available for Brits if they’re visiting the country?

The arrival of Airbnb has helped to transform the travel industry in recent years. On any one night, over two million people stay in homes advertised through Airbnb in 65,000 cities around the world.

Find out about the safety of travelling to Italy as well as the medical care available to Brits and how to get around.

If you’re jetting off to Japan soon make sure you have good travel insurance to cover your trip. The right policy may offer more protection than the standard medical care UK citizens can access when they visit.

If you're living with cancer but love to travel, can you get travel insurance for your trip?

It’s exciting when your child takes their first trip without you. Whether it’s a school visit, a holiday with friends or a gap year adventure, you’ll feel proud… but it’s normal to worry too.

Travel insurance is essential for any trip. It can help protect you from things like flight cancellations, medical emergencies and lost luggage.

Thinking of going on a cruise? Learn how cruise travel insurance protects you from unexpected events on board, at sea and on land, for smooth sailing and a stress-free experience.

There are several ways to get to the top of the class on your flight – whether that's business or even first.

Greece and the Greek islands have long been a popular travel destination for us Brits. But are there any travel risks or other factors to keep in mind before and when you go?

Travelling with high blood pressure is fine – but it’s important to make sure you’ve got the right cover in case something goes wrong abroad.

So, you’ve booked your flights, accommodation and activities. What next?

A surprising number of items get lost on holiday. Learn what you can insure and how to keep it safe.

Canada is a vast country of diverse delights – everything from bustling cities to snow-capped mountains, deep forests and crystal clear lakes. If you're thinking of experiencing them, it's time to consider your travel insurance.

People flock to the Canary Islands from all over Europe. No wonder, with such appealing beaches, landscapes and temperatures to enjoy.

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

The above details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

(2) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to:

365 days for persons aged up to and including age 70

90 days for persons aged between 71 and 75

31 days for persons aged between 76 and above