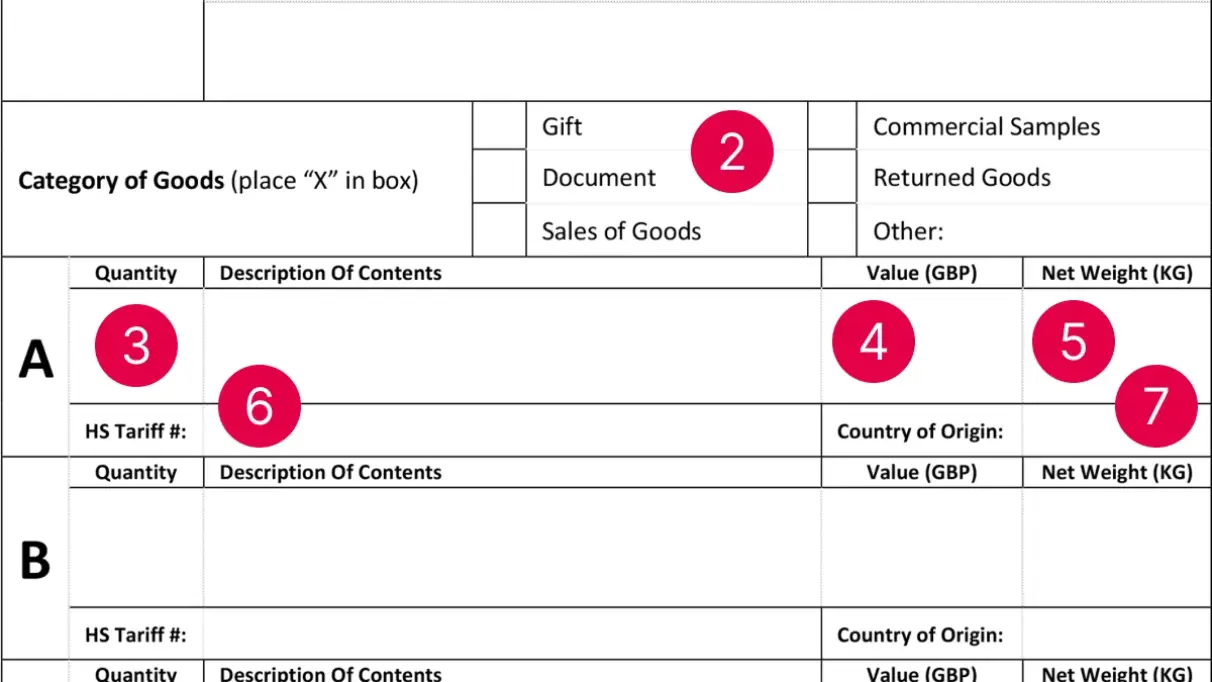

CN22 form guide

Custom forms are mandatory for all gifts and goods sent outside the UK from England, Scotland or Wales. If posting from Northern Ireland, they're only needed for non-EU destinations, except the UK.

If you have a printer, you can complete this form online or download a blank copy to fill in by hand before you visit a branch. If you don't have a printer, you can pick one up in branch.

Customs forms are scanned by optical character recognition, so it's important to fill them in legibly and in BLOCK CAPITALS.

Incomplete or missing customs forms are likely to result in items being returned to the sender.